Conclusion: Wrapping Up The Facts

1. How does it cover your experiences?

Travel insurance can help protect your experiences by reimbursing you for unused prepaid expenses if covered circumstances force you to cancel or interrupt your trip earlier than planned. This means you can travel again sooner, with less waiting to refill your bank account.

2. What does it not cover?

Travel insurance doesn’t cover everything you might do or experience when you travel. The exclusions list can differ from policy to policy, so it’s always good to read your policy before you buy.

- Extreme sports where the chance of death or injury is high

- Things you do while under the influence of controlled substances

- Fear of traveling to countries, such as those listed on the State Department’s Do Not Travel list

- Learning to fly a plane

- Playing professional sports

- Pregnancy

- Medical travel

Always read your policy before you buy, or discuss your questions and concerns directly with the insurance provider. Travel insurance experts can help you determine what plan is best for your type of trip and your concerns.

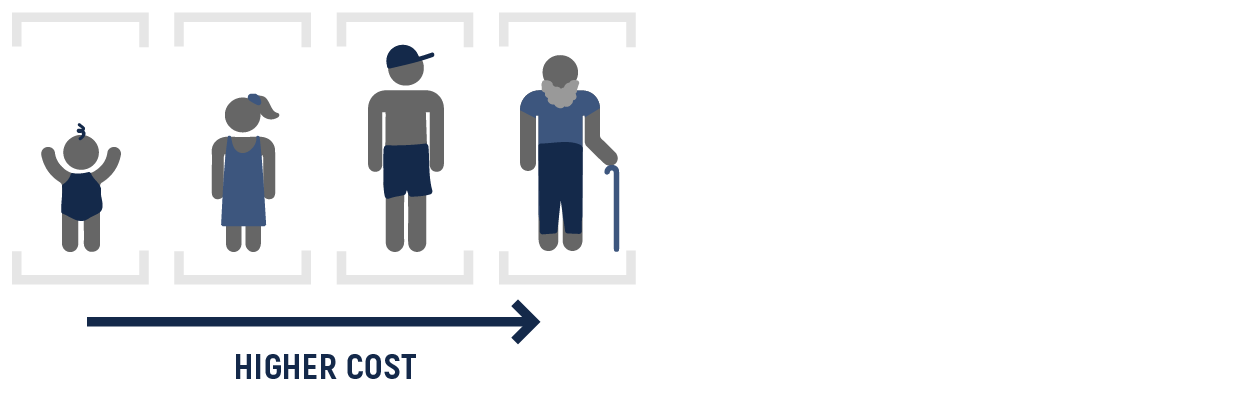

3. How much does it cost?

Travel insurance typically costs 5 to 10 percent of your total trip cost, though that amount can be influenced by several factors, including:

- Your age

- How much you’re spending on your trip

- The amount of coverage you’re choosing

- The number of people covered under your policy

- Where you are going

- How many days you are traveling

Your price depends on the element of risk. When figuring out how much travel insurance costs, remember the price you pay depends in large part on how large of a trip investment you are making – your trip cost!

Age, trip cost, plan type, number of travelers, and for some plans destination and trip length: all these factors can help determine risk, and often determine the cost of your policy.

4. Can you get discounts on it?

Discounts are not permissible in travel insurance. Our plans and rates are required to be filed with each state, and travel insurance providers are prohibited from offering discounts off the filed pricing. Any reduction in price must be based on a rate filed with the state department of insurance. Our ExactCare plan does offer family-friendly pricing, meaning that 2 children are included in the coverage for every covered adult.

![]()

5. Why should I buy it?

You should consider buying travel insurance if:

- You’re afraid something might happen that would force you to cancel your trip

- You’re concerned something may force you to interrupt your trip, return home early forcing you to give up your remaining trip and what you paid for it, and paying change fees to fly home earlier than planned

- You’re not sure what you’d do if you had a medical emergency while you were traveling

- You want to protect your belongings from loss, damage, or theft

- You want travel help ready and waiting in a travel emergency

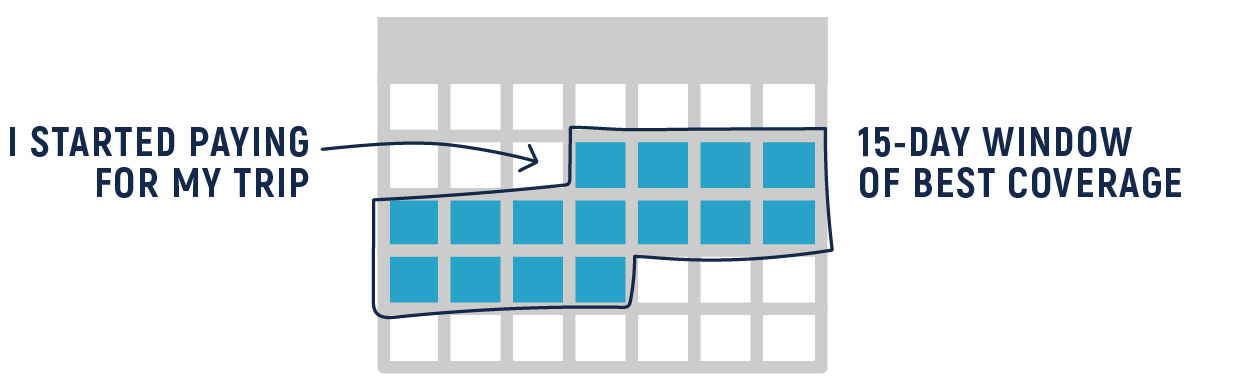

6. When should I buy it?

The best time to buy travel insurance is within 15 days of making the first deposit on your trip, since buying early can often qualify you for bonus coverages. However, many plans let you buy coverage up until the day before you leave. Just make sure you understand what is and isn’t covered if you don’t purchase within that 15-day window of making your initial trip deposit. The 15-day window (or the policy’s specified timeframe) applies to your specific policy.

7. Why is my initial trip deposit date needed?

This date often determines whether you get bonus coverages, such as:

- Tour-operator bankruptcy protection

- In some instances, terrorism coverage

- A waiver of the exclusion for pre-existing medical conditions

- Changing medical coverage from primary to secondary

You did it! Thanks for reading all about travel insurance. You're now officially informed on the in's and out's of travel insurance and most importantly how it can affect you.

Are You Ready To Shop For Travel Insurance?

Getting a quote is quick, easy and no obligation.